estate tax changes effective date

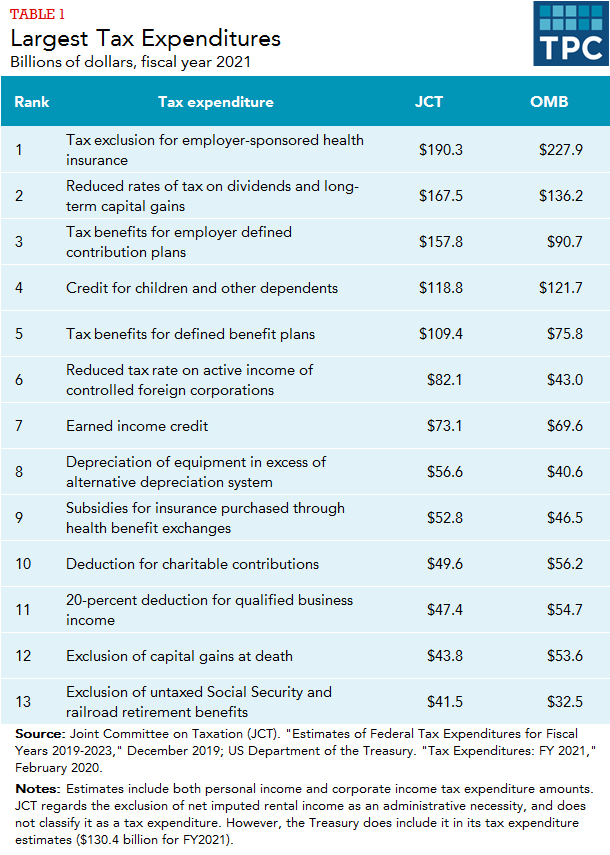

Through February 15 2021. Among other things the bill would increase the individual ordinary income tax rate from 37 to 396 increase the capital gains rate from 20 to 25 expand the application of.

Washington Policy Research Nov 16 2021 Private Wealth Management

Subjecting grantor trusts to estate tax.

. The unified estate and gift tax exemption is currently 117 million and is already. Estate and Gift Tax Exemption Reduction Using the Excess Exemption Before Its Lost. New Process for Obtaining an Estate Tax Closing Letter Effective October 28 2021 Final regulations User Fee for Estate Tax Closing Letter TD 9957 PDF establishing a new user fee.

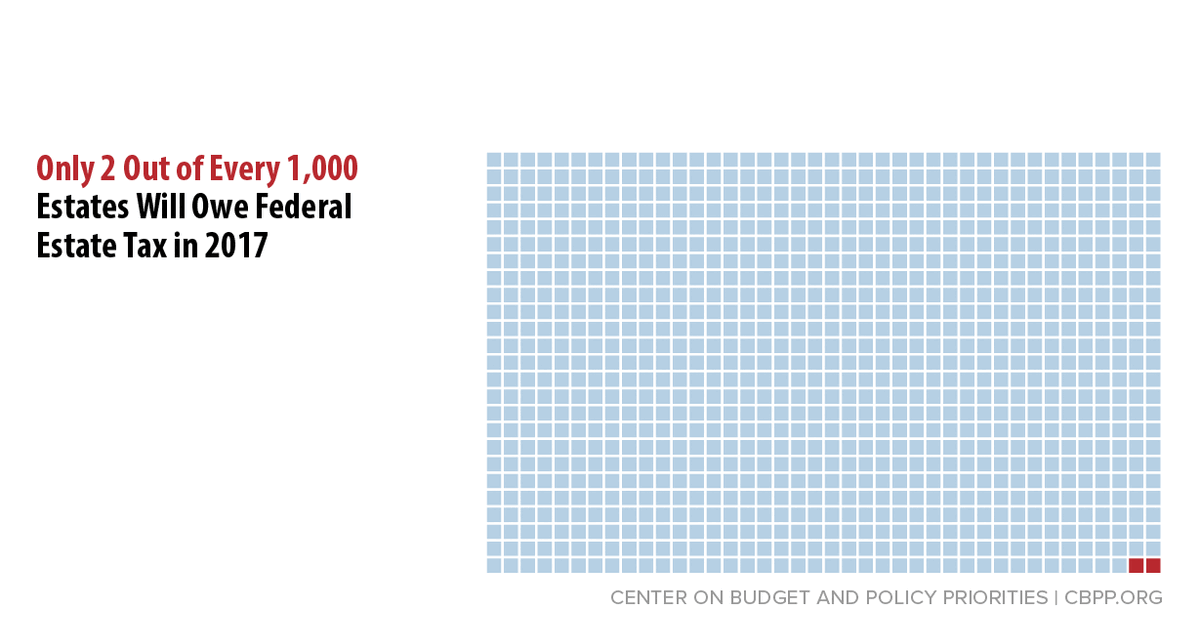

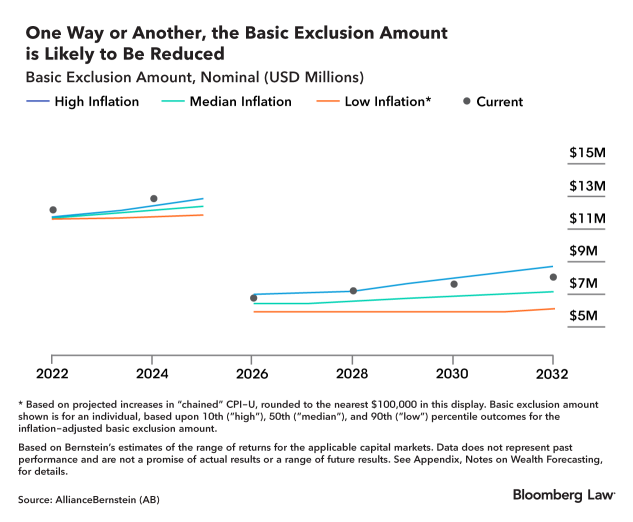

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Effective date this provision is effective for tax years beginning january 1 2022. Estate tax changes effective date.

The proposed capital gains brackets are adjusted to match. Increase income taxeseffective January 1 2022. The proposed effective date for changes in the gift and estate tax exemptions.

It includes federal estate tax rate increases to 45 for estates over 35 million with further increased rates up to 65 for estates over 1 billion. 2 increases the top capital gains rate from 20 percent to 25 percent for top marginal income tax brackets starting at 400000 for single filers. Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022 The good news on this front is that the reduction of the estate and gift tax exemption.

Potential for the estate exemption to go down to 5M indexed for inflation on January 1 2022. The Biden Administration has proposed significant changes to the. The basic exclusion amount.

Any modification to the federal estate tax rate. Revenue Taxation Code section 631 implements Propositions 58193 Revenue and Taxation Code section 632 implements Proposition 19 Important Dates. State Tax Changes Taking Effect July 1 2022.

It remains at 40. Twenty-one states and the District of Columbia had significant state tax changes take effect on January 1 2022. Reducing the estate and gift tax exemption to 6020000 effective January 1 2022.

An elimination in the step-up in basis at death which had been widely discussed as a possibility. The current 2021 gift and estate tax exemption is 117 million for each US. Effective July 1 in accordance with HB 1221 New Hampshire lawmakers will pass along a portion of the states budget surplus to local political subdivisions with the intent that.

The proposed effective date for changes in the gift and estate tax exemptions. Some also would enhance the tax savings from creating conservation easements on real estate. Those changes include.

July 13 2021.

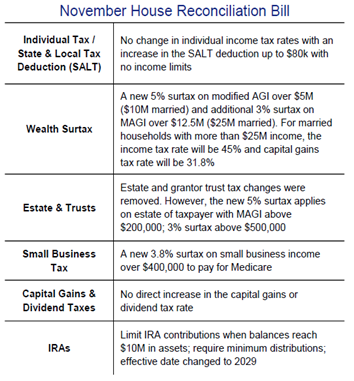

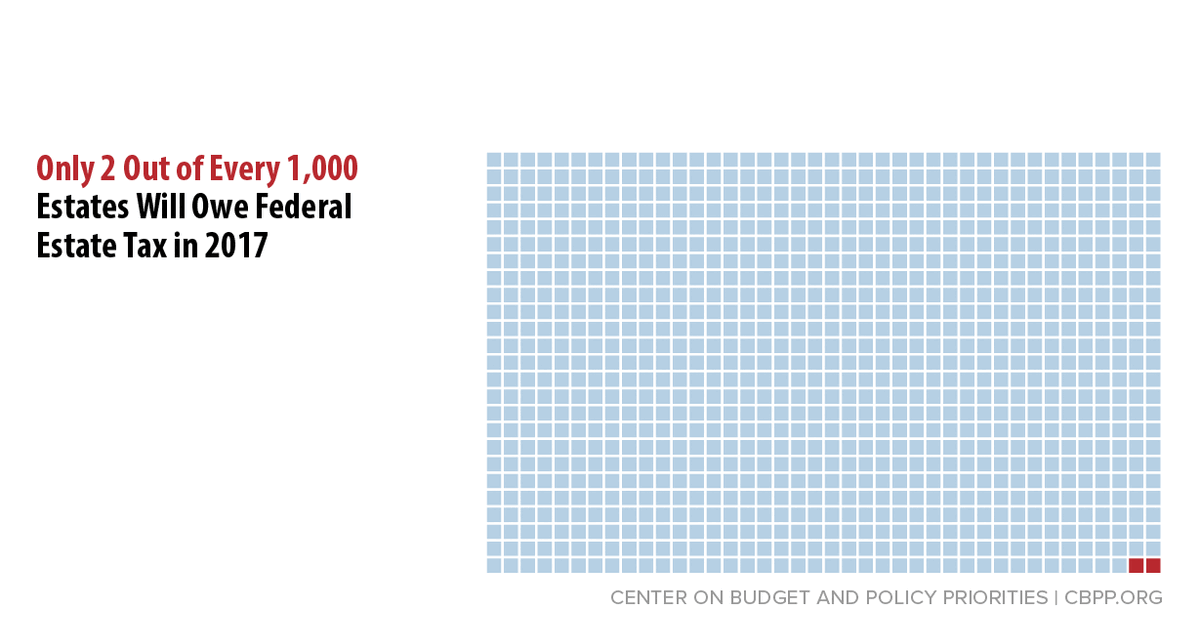

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

How The Tcja Tax Law Affects Your Personal Finances

Tax Changes For 2022 Kiplinger

Estate Tax Exemption For 2023 Kiplinger

Biden Tax Plan And 2020 Year End Planning Opportunities

How The Tcja Tax Law Affects Your Personal Finances

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Four More Years For The Heightened Gift And Tax Estate Exclusion

.jpg)

Federal Estate Tax Planning Alert For Utbf Clients David M Frees Iii

Estate And Inheritance Taxes Around The World Tax Foundation

How The Tcja Tax Law Affects Your Personal Finances

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Effective Dates Of Estate And Gift Tax Changes In The House Bill Somerset Cpas And Advisors

Estate Tax Current Law 2026 Biden Tax Proposal